Looking through one of my financial statements earlier this year, I noticed a document with the title “What is your American Dream?” I thought back to a few things I’ve always aspired to do: go to college, have a rewarding career and most importantly, become a homeowner. Owning a home of my own stood out as the obvious priority, having earned my degree and built a career I find rewarding.

I remember being 5 years old when my family moved from our apartment in Washington, D.C. to a home in the suburbs of Maryland. It was there, I learned to play baseball and basketball, ride a bicycle and roller skate. It meant a lot to have a safe and peaceful place to grow up. It also meant a lot grow up with other hard-working black families. I gained a sense of pride I still have today. Because of this, my mind was set to work toward being able to do the same for my own family one day. But the sad reality is fewer Americans, especially black Americans, are able to do this. Black homeownership has hit at an all-time low. With rising housing costs, lack of housing supply, and a dark history of redlining, black people have been shut out of achieving homeownership. And far too many saw their American Dream turned into a nightmare due to equity stripping schemes made possible by toxic refinancing products.

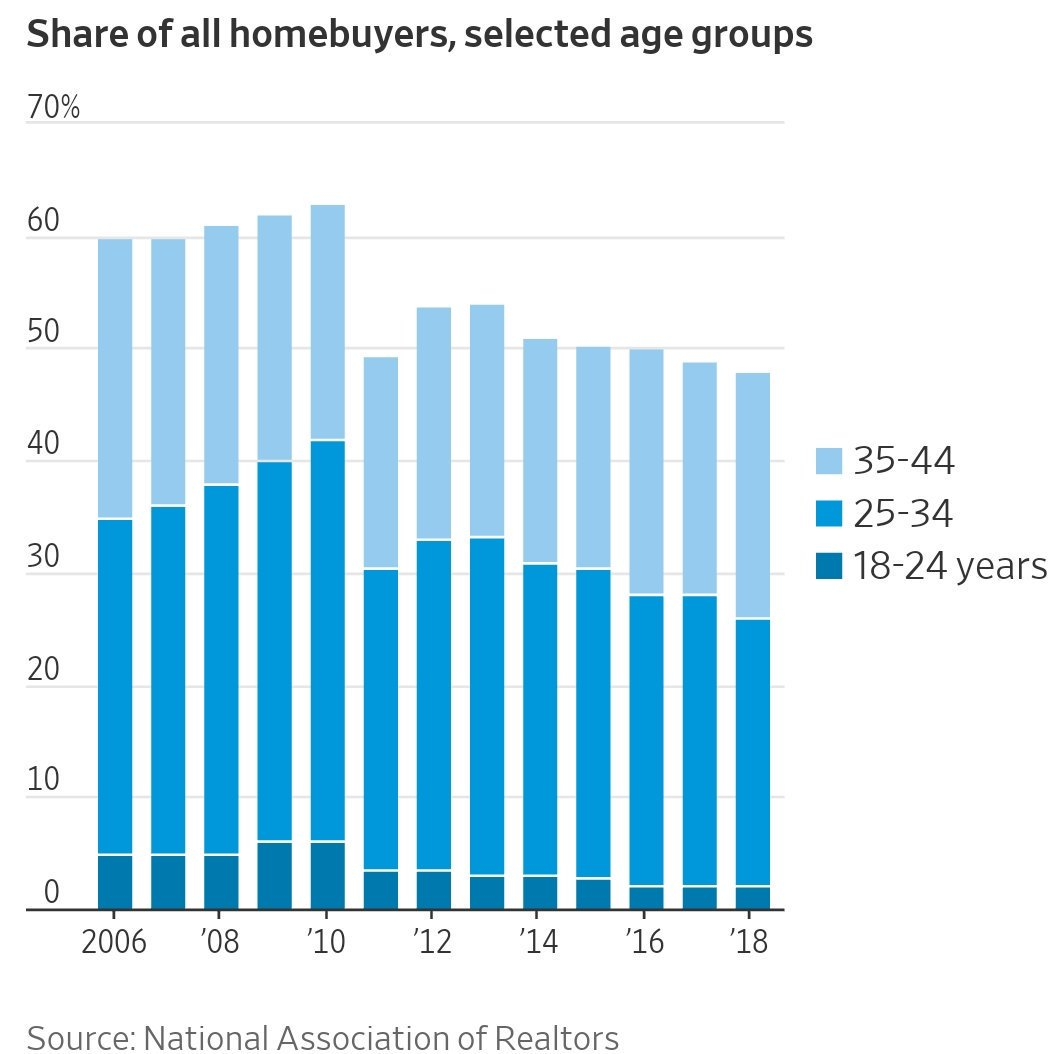

I knew the odds were against me going into the homebuying process being both African-American and a millennial. This is why I spent years preparing for homeownership by saving and educating myself with helpful resources from Realtor.com, NHC member the National Association of REALTORS® and the Consumer Financial Protection Bureau. I was one of the 1 and 5 millennials who lived at home. I had to live at home if I was going to save money, pay down my student loans and live comfortably.

As in many metropolitan areas, affordable housing options in the DC-Metro area are scarce, and this trend is on a path to get even worse. The average fair market rent for a one-bedroom apartment in the Washington, D.C. metro area is $1,454— more than I will pay for my mortgage! It’s encouraging to learn that Maryland is putting more funding toward affordable housing.

This summer was the perfect time for me to buy a home, with mortgage rates hitting a three-year low. My first step was to get pre-qualified by more than one lender. I started with my own credit union. If I had to do it again, I probably would have sought more lenders. As Fannie Mae points out , it does pay off to shop around. When getting pre-qualified, I explored FHA options first, because I thought it was my only option if I wanted to do a low-down payment. I also learned there are other low down payment options with conventional loans as well.

When I wasn’t satisfied with the increased interest rate my credit union provided, I decided to go with another lender. The loan officer there was someone I could meet with face-to-face and build a relationship, rather than working with someone who was in a different state. This was important for me to be more comfortable with the homebuying process. Being referred to a REALTOR by a trusted friend, instead of searching for one, also helped me be more comfortable. My Long & Foster real estate agent made sure I understood the process and was always available to answer my questions right away, mainly by text (it’s the millennial in me). Then, the fun part, home shopping! I used Zillow, Realtor.com and Trulia to find options that fit my price and my affordability range and preferences. In the current sellers’ market, affordable options that were move-in ready seemed rare and this was discouraging, but I was determined to have my dream place by the end of the summer.

While home shopping, I took another first-time homebuying class, which was HUD-approved (I recommend taking two different classes to gain different perspectives). It was helpful to get refreshed on the do’s and don’ts and learn about local resources available to first-time homebuyers such as the Maryland Mortgage Program and Habitat for Humanity Metro Maryland Home Purchase program. It was also helpful to have a supportive circle of friends, family and co-workers who were there to encourage me and provide helpful tips.

This week, I celebrated my first month as a homeowner and thought back to my closing day. I was overjoyed with a newfound sense of accomplishment. It’s a day I will always remember and cherish. It marked a major milestone. A milestone that is a big step toward building wealth for years to come.

Regardless if one chooses to rent or buy, it’s a basic right for anyone to be able to live anywhere they choose to with local and federal policies in place that protect this right.

· No one should be priced out of communities because of their income or race.

· No one should be cost-burdened to the point where a choice must be made between being able to pay for basic necessities such as food and medical care.

· No one should be driven into communities that are stripped of quality schools, economic advancement opportunities and access to healthy food options and grocery stores.

As Daniel Scheinaman of the Ohio Capital Corporation for Housing, an emerging leader in housing put it, “housing inequality is one of the cornerstones of injustice in America.” Everyone deserves an equal opportunity at achieving their own American Dream, where they can live and prosper in affordable, quality and safe communities.